Workers at the world’s largest copper mine in northern Chile have gone on strike on Tuesday, hours after failing to reach an agreement with Australian group BHP, according to their union.

Workers walked out as they demanded a bigger slice of copper profits, which have been buoyed by recent high prices.

BHP later said it had begun to remove striking workers at its Escondida mine, located in Antofagasta.

"After a new invitation from the company to reach an agreement, Union No. 1 declined to restart talks," BHP said in a statement, referring to the labour group that represents about 2,400 people.

BHP said it began removing striking workers when it activated a contingency plan that allows for "minimum services" and for non-union members to keep working.

The union maintains it is willing to return to negotiations, and accused BHP of violating strike terms by replacing workers who walked out, who it said were essential to basic operations.

The strike, after the union encouraged members to reject BHP's offer, has stirred up memories of the last major Escondida walkout in 2017, which hit BHP's copper production and pushed up global prices of the metal, which is used to make wiring and nearly every single electronic device.

Workers from one of three unions at Lundin Mining's Caserones copper mine in Chile also went on strike on Tuesday over failed pay negotiations.

BHP defended its contract as one of the best in the industry, and said it had offered four proposals in response to points raised by the union. The labour group "on the last day of mediation presented new requirements," BHP said in a statement.

While the Escondida strike is unlikely to affect Caserones, the outcome could influence future negotiations at other mines, said Benchmark Mineral Intelligence, a U.K.-based provider of critical minerals pricing and data.

They also noted that Escondida processes 400,000 tons of ore a day, a pipeline that could be disrupted shortly after workers walk out.

BHP offered a USD 28,900 bonus per worker, compared with the union's demand of 1 per cent of shareholder dividends for the mine, which would amount to roughly USD 36,000.

2008 Mumbai attacks accused arrives in India after US extradition

2008 Mumbai attacks accused arrives in India after US extradition

Hezbollah ready for talks with Lebanese government, MP says

Hezbollah ready for talks with Lebanese government, MP says

Talks between US, Ukraine on minerals deal to start Friday

Talks between US, Ukraine on minerals deal to start Friday

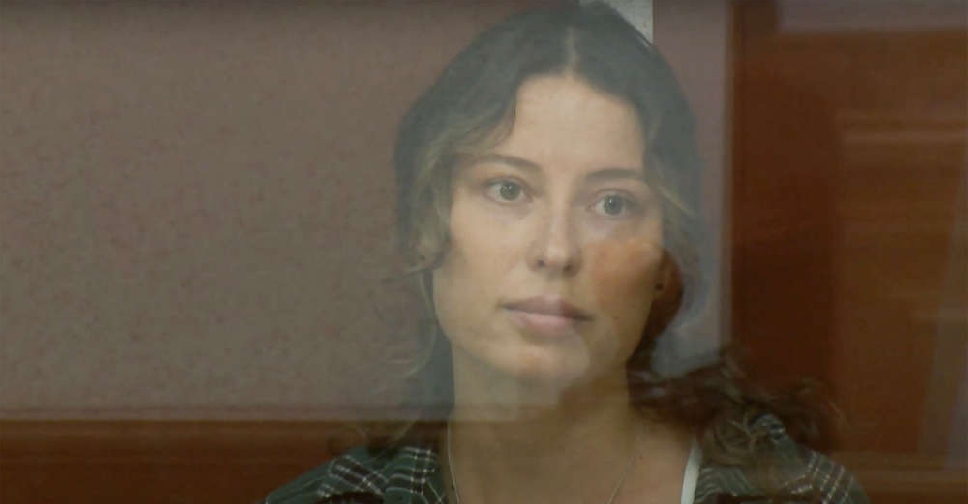

Dual national prisoners head home in US-Russia swap

Dual national prisoners head home in US-Russia swap